CTC Calculator: Check Your Salary & Take-Home Pay in 2025

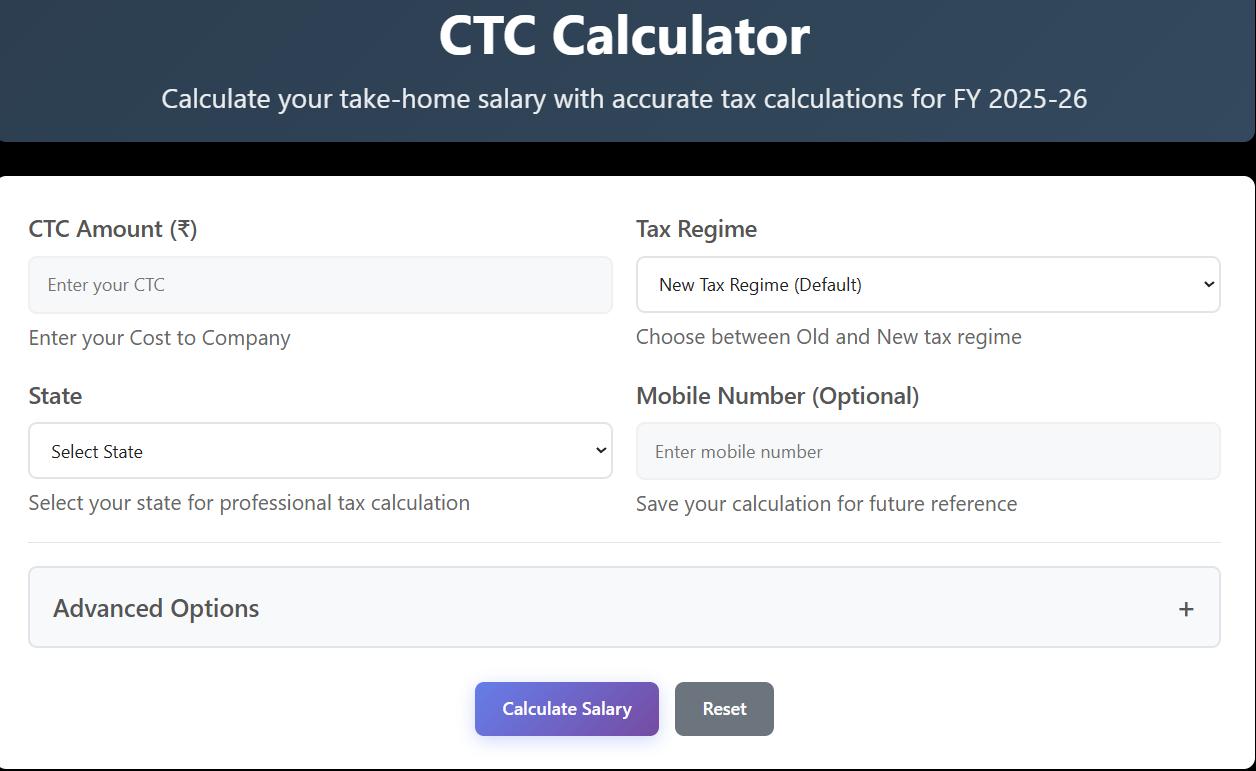

CTC Calculator

Calculate your take-home salary with accurate tax calculations for FY 2025-26

When you hear the word CTC in your job offer, it sounds big. But most people later realize the money they actually get in hand is much less.

That’s when a CTC calculator becomes useful. It helps you find out how much of your salary is yours to spend every month.

In simple words, CTC means how much the company spends on you in a year. But your take-home salary is only a part of that. The rest goes into taxes, PF, and other benefits that you don’t get directly.

What is CTC (Cost to Company)?

The total amount a firm spends annually per employee is known as the cost to company (CTC).

Your salary, incentives, perks, and employer contributions are included.

Here is a brief example:

Should your business pay you ₹6 lakh yearly, that might encompass:

- Basic pay

- HRA (house rent allowance)

- Special allowances

- Bonus or yearly incentive

- Employer PF contribution

- Gratuity

Thus, even if the letter specifies ₹6 lakh, the amount in your account will be lower as some components are future benefits or deductions.

In simple words, CTC = Direct Benefits + Indirect Benefits + Employer Contributions

Here’s what that means:

- Direct Benefits – Your monthly salary components, like Basic Pay, HRA (House Rent Allowance), and Special Allowances.

- Indirect Benefits – Perks like health insurance, meal coupons, or company-provided accommodation.

- Employer Contributions – Contributions towards Provident Fund (PF), Gratuity, and other statutory payments.

So, when you use a CTC calculator, it helps you break down these components to understand how much you’ll actually get in hand each month.

Gross Pay vs In-Hand Salary

These two are simple to mix up; thus, let’s clarify it:

- The total salary before PF or tax deductions is the gross salary.

- Your in-hand pay is what’s left following all the deductions.

Example:

Gross might be ₹8.4 lakh if your annual CTC is ₹10 lakh.

After PF and taxes, you could get ₹ 65-70 thousand per month.

This is the reason a calculator is beneficial; it handles all this mathematics for you.

Why You Should Use a CTC Calculator in India

How the CTC Calculator Helps

You don’t need to know formulas or tax rules. You just fill in a few details, and the calculator shows your real salary step by step.

What You Enter

- Total CTC per year

- City (metro or non-metro)

- Tax regime (old or new)

- Bonus amount

- PF or professional tax (if any)

What You Get

- Gross salary (monthly and yearly)

- Employer’s contributions

- Deductions

- Final take-home amount

It’s a simple way to see what your paycheck will really look like.

Why You Should Use a CTC Calculator in India

A CTC calculator India is a practical tool that simplifies complex salary structures. Instead of manually calculating every deduction and allowance, the calculator gives you a clear picture of your net take-home pay within seconds.

Here’s why it’s essential:

Why You Should Try It

It clears the confusion.

You’ll know exactly how much you earn and where it goes.

You can compare job offers.

Two offers with the same CTC may give very different in-hand amounts.

You plan better.

Once you know your real income, you can handle rent, EMIs, and savings easily.

You can check which tax regime suits you.

Sometimes the new regime gives a higher take-home. Sometimes not.

No surprises on payday.

The calculator tells you the truth before you join.

What’s Inside Your CTC

| Salary Part | What It Means | Taxable? |

|---|---|---|

| Basic Pay | Fixed part of your salary | Fully taxable |

| HRA | Money for rent | Partly exempt |

| Special Allowance | Extra cash added to pay | Taxable |

| Bonus | Performance or yearly reward | Taxable |

| Employer PF | Company’s share in your savings | Non-taxable |

| Gratuity | Paid after long service | Mostly non-taxable |

All these parts together make your full CTC.

But remember – not all of it comes to your pocket.

How to Use the CTC Calculator?

Quick guide for the CTC calculator at https://ctc-calculator.in

Enter your annual CTC

At the top of the calculator page, you’ll see a field labeled Cost to Company (CTC) ₹ / year.

- Input the full amount your employer has offered as your annual CTC.

- You can usually find this in your offer letter or salary package document.

- Make sure you enter the yearly amount (not just monthly) if the toggle is set to annually.

Select Monthly or Yearly View (if available)

Some calculators allow you to toggle between Monthly and Yearly mode.

- To view your monthly in-hand salary, switch to the Monthly view.

- If you prefer the annual picture, stay with Yearly.

- The calculator will automatically adjust the results accordingly.

Use Advanced/Optional Settings (if needed)

If you see an Advanced Settings section (or similar), you can fine-tune your calculation by entering details such as:

- Bonus included in your CTC

- Employer’s contributions (PF, gratuity, insurance)

- Employee’s deductions (PF deduction, professional tax, other deductions)

- These optional fields help tailor the result to your specific package and make the estimate more accurate.

Click Calculate / View Result

Once you have entered all the required values, click the Calculate (or equivalent) button. Within seconds, you will see:

- Estimated in-hand salary (monthly and/or annually)

- Breakdown of major components (such as basic salary, allowances)

- Total deductions (such as PF, taxes)

- Possibly employer contributions (non-cash benefits)

- This gives you a realistic picture of what you’ll actually receive.

How Does a CTC Calculator Work?

A CTC calculator works by splitting your total salary package into its core elements. You just need to enter basic details such as your annual CTC, bonus (if any), and deduction percentages.

Here’s a quick breakdown of how the calculation works:

- Enter Annual CTC – The total amount offered by your company.

- Input Bonus or Incentives – Annual or performance-based bonuses.

- Add Employer Contributions – Such as PF (12% of Basic Salary) and Gratuity (4.81% of Basic).

- Subtract Deductions – Including income tax, employee PF, and professional tax.

- Get Take-Home Salary – The calculator shows your monthly in-hand salary after all deductions.

This makes the CTC calculator a time-saving and accurate tool for both employees and HR professionals.

NOTE: For save your results to see in future, simply entrt mobile Number and save your Calculation.

CTC vs In-Hand Salary – The Real Difference

This is one of the most common confusions among employees. When you receive an offer letter, the CTC may look attractive – but that doesn’t mean you’ll receive that full amount.

Here’s the main difference:

Salary Components Explained

CTC (Cost to Company)

Includes every cost the company bears on you-such as Provident Fund (PF), gratuity, bonuses, health insurance, and other benefits.

In-Hand Salary

The actual amount you receive in your bank account every month after taxes and deductions.

So, if your CTC is ₹8,00,000 per year, your in-hand salary could be ₹55,000–₹60,000 per month, depending on benefits and deductions. Using a CTC calculator India can help you understand this gap precisely.

Components Included in CTC

To understand your salary better, here are the major components included in your CTC salary structure:

- Basic Salary – The core of your salary; usually 35–50% of CTC.

- HRA (House Rent Allowance) – For employees living in rented accommodation.

- Conveyance Allowance – For commuting expenses.

- Medical Insurance – Paid by the employer for health coverage.

- Performance Bonus – Variable component based on your work.

- PF and Gratuity – Long-term savings and retirement benefits.

Knowing these elements helps you make sense of the figures you see in a CTC calculator.

How to Negotiate Better Using a CTC Calculator

Before accepting any job offer, always check the take-home amount using a CTC calculator. Sometimes, a lower CTC with a higher in-hand salary is better than a bigger CTC filled with non-cash benefits.

Here are some tips:

- Ask for a CTC breakup from HR.

- Focus on in-hand pay, not just the total CTC.

- Negotiate for tax-efficient benefits (like higher HRA, LTA, or reimbursements).

- Compare offers using the calculator for a real picture of earnings.

Quick Tips

Don’t judge a job by CTC alone.

The package looks big, but your in-hand can be very different.

Always check your take-home before you accept.

Know what lands in your bank each month, not just yearly numbers.

Compare both tax regimes once a year.

Sometimes the old one wins, sometimes the new one does.

Use deductions like 80C to save tax.

Small planned investments can reduce your taxable income.

Look at PF and gratuity as savings, not losses.

They grow quietly in the background and help long-term.

These small checks make a big difference later.

Do them once, and your money plan gets a lot clearer.

Latest 2025 Insights on Salary Structures in India

In 2025, many companies in India are adopting flexi-salary structures, giving employees the option to customize components like bonuses, insurance, and allowances.

With hybrid work becoming standard, benefits like travel reimbursements are being replaced by remote work allowances.Also, new tax regimes are encouraging individuals to plan better with tools like CTC calculators to maximize post-tax income.

If you’re starting a new job or switching roles this year, understanding your salary through a reliable CTC calculator is a must.

A CTC calculator is more than a number-crunching tool – it’s a financial clarity tool for professionals. It helps you make informed decisions, compare job offers wisely, and plan your finances efficiently.

Understanding your CTC not only gives you control over your earnings but also ensures there are no surprises when your first paycheck arrives.

If you want to make smarter salary decisions, start using a CTC calculator India today and take full control of your financial planning.

FAQs

Final Thoughts

A CTC calculator is the easiest way to understand what your salary really means. It’s quick, simple, and perfect for anyone starting a new job or comparing offers. When you know your true in-hand pay, you plan better and feel more confident. Try one today, it only takes a minute to see the real number behind your CTC.